Did you know you can reduce your income tax bill or claim back thousands in workers’ tax credits if you haven’t already? The main tax credits you can claim back are:

Renter’s tax credit

This was brought in by the government in 2022. If you paid tax and rent in 2022 or 2023, you should go into your Revenue Online account and claim it. Revenue Commission will pay you back directly the amount you are owed. You are eligible if you paid rent to a registered private landlord (not rent a room), were paying income tax that year and not getting housing assistance from the government (e.g. HAP, RAS, rent supplement). If you’re renting and working this year 2024, you should claim the credit now too. Totals you can claim back:

- 2022: €500 for single person / €1,000 for a couple

- 2023: €500 for single person / €1,000 for a couple

- 2024: €750 for single person / €1,500 for a couple

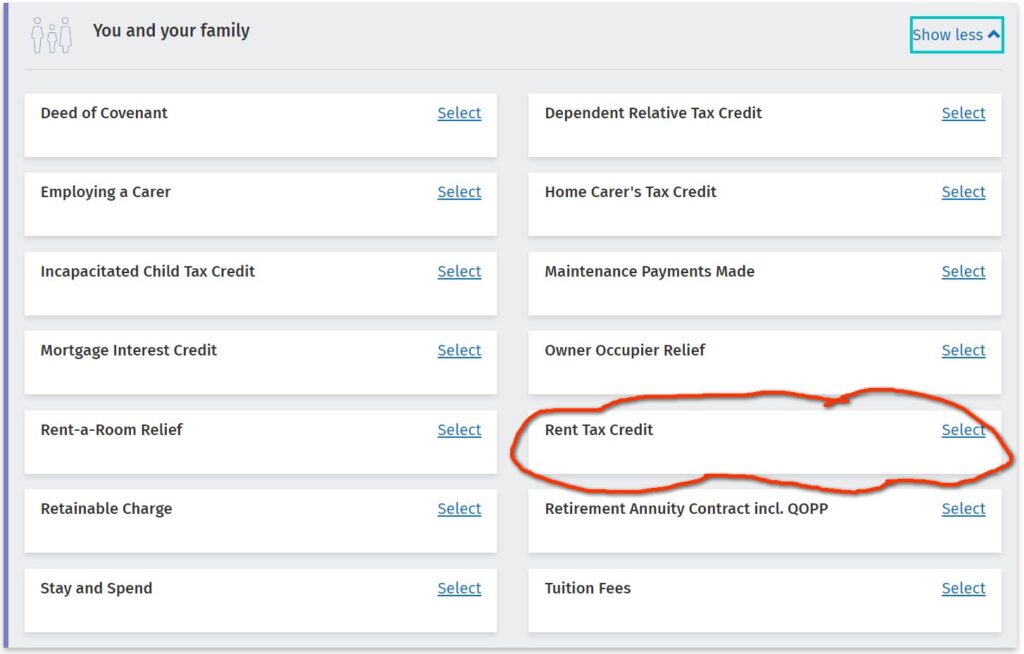

Go into your Revenue Online account, choose manage your tax for each relevant year, and continue to the options for tax credits.

Working from home expenses

You can also claim tax relief on your working from home expenses – up to 30% of your electricity, heating and internet costs for each day you work from home. Given many households have bills of about €2,500 on these areas, you could save around €200 a year if you’re working from home 2 days a week (double that if you’re a couple working 2 days a week from home each). There’s no limit, so if you work from home 5 days a week, you could be looking at claiming €500/year back. If your employer contributes to your home utilities expenses, part of this could be deducted from your tax relief.

Same as the renter’s tax credit, this tax relief can be claimed by logging into your Revenue Online account and clicking manage your tax.

Mortgage Interest Relief tax credit

If your mortgage interest payments went up in 2023, you could be eligible for this tax relief. See here for more details of eligibility and how to apply.

Health expenses

I know many families struggle with health expenses, especially if you earn too much for a medical card/GP visit card but can’t afford health insurance. A full list of the eligible expenses is here and you can apply for the tax credit by logging into your Revenue Online account and clicking Manage Tax.

Other workers tax credits and tax relief

There are all sorts of other workers tax credits and relief you can apply for. A full guide is on the Citizens Information website here.